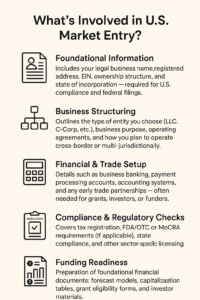

🔁 What’s Involved in U.S. Market Entry?

Foundational Information

Foundational Information

Includes your legal business name, registered address, EIN, ownership structure, and state of incorporation — required for U.S. compliance and federal filings.

Business Structuring

Outlines the type of entity you choose (LLC, C-Corp, etc.), business purpose, operating agreements, and how you plan to operate cross-border or multi-jurisdictionally.

Financial & Trade Setup

Details such as business banking, payment processing accounts, accounting systems, and any early trade partnerships — often needed for grants, investors, or funders.

Compliance & Regulatory Checks

Covers tax registration, FDA/OTC or MoCRA requirements (if applicable), state compliance, and other sector-specific licensing.

Funding Readiness

Preparation of foundational financial documents: forecast models, capitalization tables, grant eligibility forms, and investor materials.